The 8-Minute Rule for P3 Accounting Llc

Wiki Article

The Single Strategy To Use For P3 Accounting Llc

Table of ContentsThe Basic Principles Of P3 Accounting Llc P3 Accounting Llc Fundamentals ExplainedNot known Factual Statements About P3 Accounting Llc Some Known Facts About P3 Accounting Llc.P3 Accounting Llc Fundamentals ExplainedP3 Accounting Llc - An Overview

Or, as Merhib put it, "You require to have guides in great order to suggest your clients on what they can be finishing with their organizations." Many companies that offer CAS offer either one or a small number of particular niches and completely reason. "Clients want experts, not generalists," Mc, Curley claimed.

Yet obtaining this knowledge takes some time, initiative, and experience. To be a reliable consultant, a CPA might require to come to be intimately acquainted with an offered market's processes, threat aspects, consumer kinds, KPIs, regulatory atmosphere, and more. CPAs who deal with medical professionals, for circumstances, require to learn about billing and Medicare, while those that deal with dining establishments need to know about food patterns, distribution prices, and state laws concerning tipping.

How P3 Accounting Llc can Save You Time, Stress, and Money.

Having a particular niche can also help firms focus their advertising efforts and select the ideal software program. It can additionally help a company improve its procedures, something ACT Services realized when it picked to specialize. The company started out as generalists, recalled Tina Moe, CPA, CGMA, the owner and CEO of ACT Solutions."I joked that our clients simply needed to be wonderful, be compliant, and pay our costs." Since they focus on three industries, Fuqua claimed, "we have the ability to systematize and automate and do points much more rapidly." Due to the fact that starting a CAS method is such an intricate task, firms require to totally dedicate to it for it to thrive (see the sidebar "Making Pizza Profit").

That indicates dedicating cash, personnel, and hours to the CAS venture. Ideally, have a person dedicated to CAS full-time, Merhib said. OKC tax deductions. Though you might start having a team member from a different area functioning part time on your CAS initiative, that's not lasting in the future, he claimed.

4 Easy Facts About P3 Accounting Llc Described

Otherwise, he stated, they'll struggle to succeed at balancing both elements of the role. Several sources currently exist to assist companies that are beginning to offer CAS. Organizations including the AICPA have actually produced products companies can make use of to find out about CAS and supply training programs that cover everything from pricing to staffing to just how to speak to clients regarding the value of CAS.After her firm took some actions towards CAS by itself, she took a CAS workshop she found really handy. "We were attempting to take bits and items of info from different sources to attempt and develop our own CAS division, yet it was like reinventing the wheel. It was really taxing," she claimed.

Some Ideas on P3 Accounting Llc You Need To Know

As an example, Hermanek and his group were able to significantly enhance a customer's money flow by obtaining them to embrace automatic accounts receivable software application. By doing so, the customer's balance dues gone down from a standard of 50 days down to 1 month. Be certain to offer your CAS personnel enough time to train on modern technology, Hermanek said.

You probably really did not start your service to process economic declarations, invest hours investigating tax conformity legislations or fret about every detail of the reductions on your staff members' payroll. The "service" side of service can often drain you of the power you desire to direct toward your core product and services.

The Main Principles Of P3 Accounting Llc

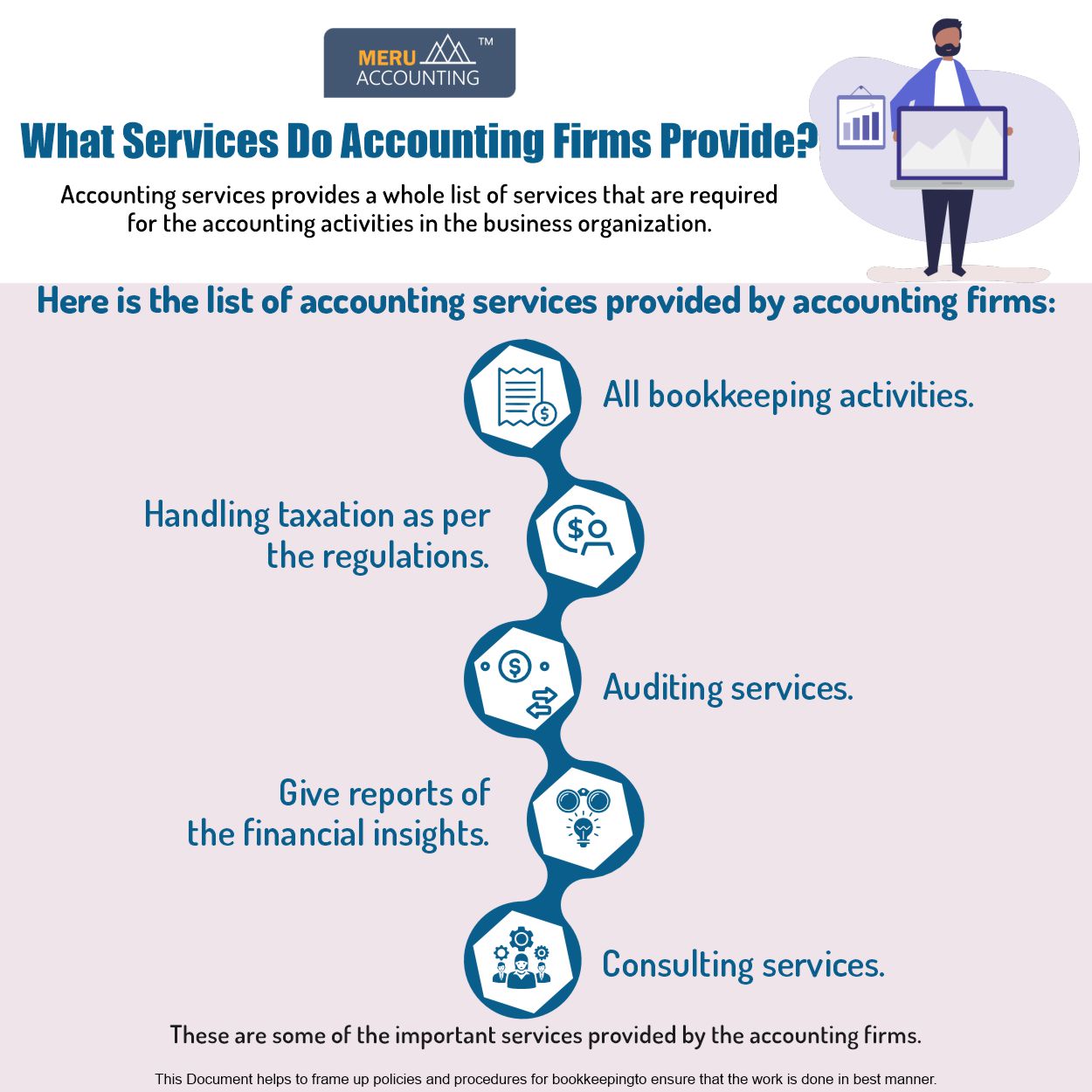

The solutions you can obtain from an expert accounting firm can be customized to satisfy your demands and can include fundamental day-to-day accounting, tax services, auditing, this post management consulting, fraud examinations and can even work as an outsourced principal financial policeman to supply monetary oversight for your local business. From the Big Four (Deloitte, Pricewaterhouse, Coopers, KPMG and Ernst & Youthful) to small-business audit firms, the primary solutions supplied include accounting and auditing.The company can aid you with long-range preparation, such as buying building or updating your facilities. It can additionally aid you determine how to recover cost and what your cash-flow needs are. These services assist you intend your following steps, identify whether you are making an earnings and make choices concerning your firm's development.

This may be a demand of your capitalists or created right into the laws of your unification. https://giphy.com/channel/p3accounting. Audit companies carry out audits by analyzing not just monetary records, however likewise the processes and controls in position to make certain documents are being effectively kept, policies are being complied with, and your monetary techniques assist support your service objectives and are one of the most efficient means to do so

P3 Accounting Llc Fundamentals Explained

A prominent specialty location, lots of accounting companies offer a range of tax solutions. The company's accounting professionals can help you figure out a brand-new tax obligation code to assist ensure your economic reporting practices are in compliance with current IRS regulations, identify your business's tax obligation responsibility, and make certain you satisfy filing demands and due dates.

Report this wiki page